What do you want me to value?

When we accept an engagement to value an asset, we are very careful to clarify exactly what the client or solicitor wishes us to value. We have seen instructions which ask us to value one asset, but actually after enquiring, want something different valued.

The key assets to be valued are:

- The Business Value

- The Enterprise Value

- The Equity Value

- Total Shareholders Interest

The difference between each of these values is best done by way of example.

Ms Lime owns 100% of Limeco Distributors Pty Limited, an import and distribution business. Limeco generates pre tax earnings of $200,000 after market based salaries.

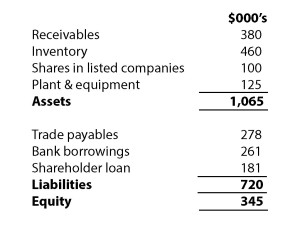

Limeco has the following balance sheet at valuation date.

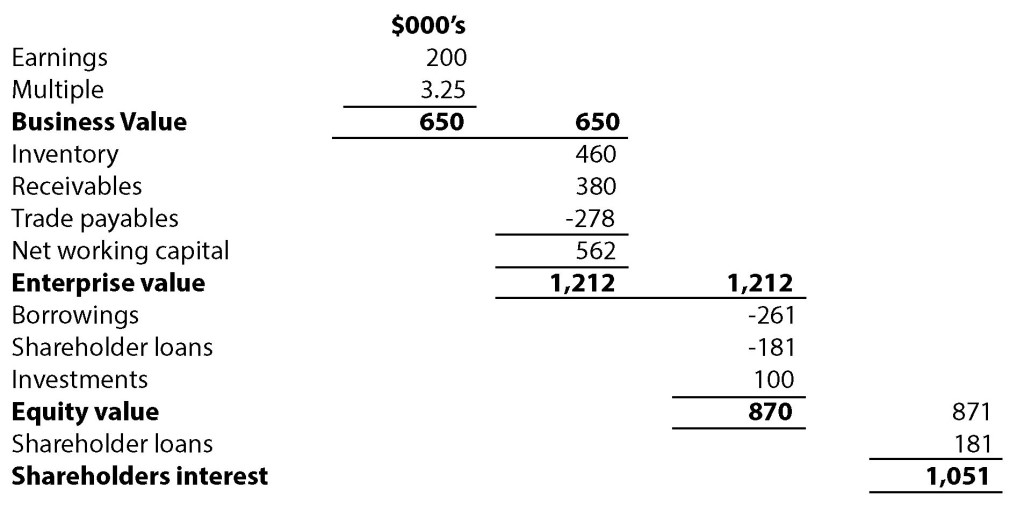

The Business Value is commonly used for small business valuations and sales. You will see businesses listed for sale by Business Brokers at a price of say $350,000 plus stock at valuation. In Limeco’s case, assuming that the appropriate business capitalisation is 3.25 times, then the business is worth $650,000 ($200,000 * 3.25).

The Enterprise Value is the Business Value plus net working capital required to operate the business. In Limeco’s case a purchaser of the business for $650,000 would have to fund both the receivables $380,000 and inventory $460,000, however, this could partially be funded by trade payables of $278,000. The Enterprise Value of Limeco is $1,212,000.

The Equity Value is the value of the shares in the company and is the Enterprise Value less any borrowings (bank and shareholders loans) plus surplus assets. In Limeco’s example the Equity Value is the Enterprise Value of $1,212,000 less bank borrowings of $261,000 and shareholders loans of $181,000 plus $100,000 shares in listed companies or $870,000.

The Total Shareholders Interest is the Equity Value plus or minus any shareholder loans. In the Limeco example, the Total Shareholder Interest is Equity Value of $870,000 plus shareholder’s loans of $181,000 being $1,051,000.

The Limeco flow of different values is as follows:

Before you issue instructions to us for a valuation, we strongly recommend that we have you consider exactly what you would like valued. Please feel free to run a draft of the instruction by us prior to issue.